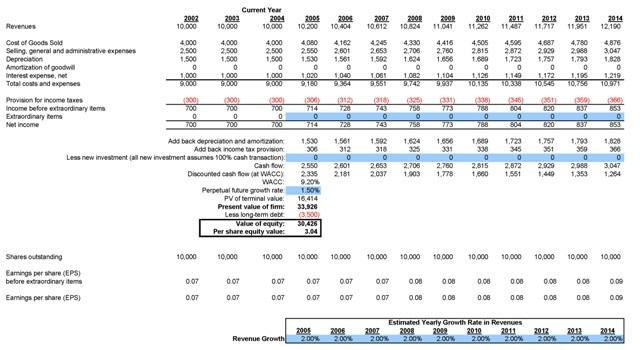

Business Valuation Model Excel Screenshot

The Business Valuation Model Excel is an "out-of-the-box" professional valuation model developed by a CFA charterholder. It is designed to accept information from publicly-available 10-K reports in order to calculate the total and per-share value of a business. The model includes a basic and common-size income statement and balance sheet, an easy-to-use cost of equity and WACC calculator, a detailed ratio analysis and a comprehensive discounted cash flow (DCF) analysis. Cells requiring user input are clearly highlighted, making valuations very easy to perform. The model is also flexible, allowing the practitioner to vary the analysis based on variables such as: expected return on the overall market, perpetual future growth rate of cash flows, expected new investments, and miscellaneous items. Changes made to one part of the model automatically flow through to the other parts, ultimately affecting the overall and per-share valuation of the company. (For example, lowering the assumed risk-free rate decreases the cost of equity, which decreases the WACC, which increases the valuation. By simply changing the risk-free rate, the valuation automatically increases.) Date and number fields may be re-formatted by the user (using Excel's built-in formatting capabilities) to accommodate non-US conventions.The Business Valuation Model for Excel is a professional-grade "out-of-the-box" valuation model designed to provide detailed valuations from publicly-available information. It provides a detailed valuation while remaining flexible and easy-to-use.

Back to Business Valuation Model Excel Details page

- Business Valuation Model

- Automated Business Valuation Model

- Simple Business Valuation Model

- Business Valuation Model Template

- Business Acquisition Valuation Model

- Business Valuation Model Xls

- Excel Model Valuation

- Excel Valuation Model

- Valuation Model Excel Template

- Acquisition Valuation Model Excel