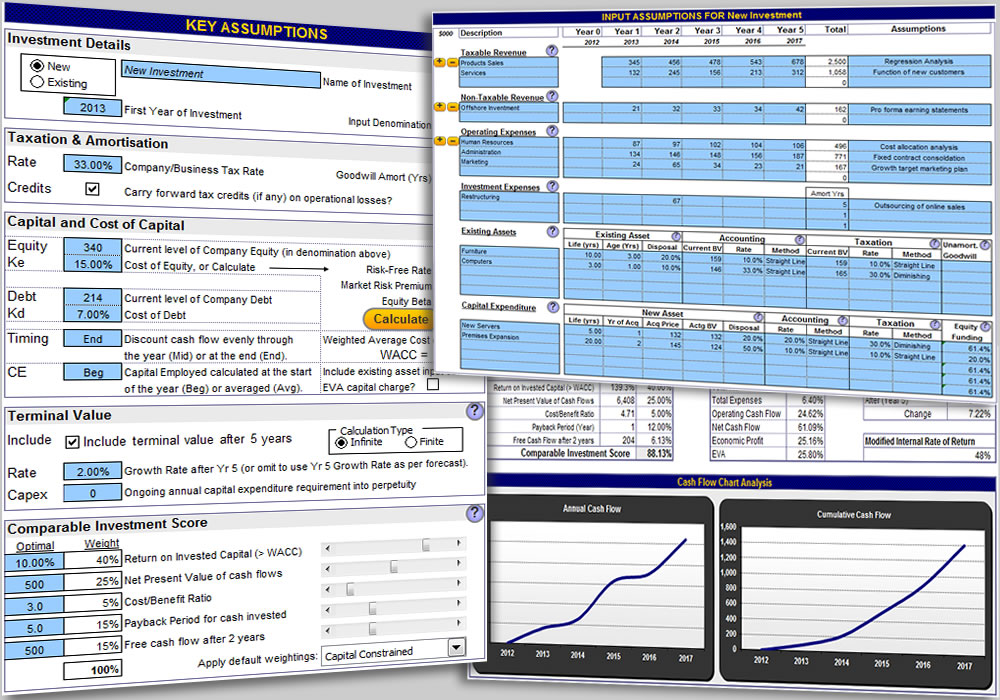

Investment and Business Valuation Screenshot

The Excel Investment and Business Valuation template is ideal for evaluating a wide range of investment, financial analysis and business plan scenarios. Business valuation is based on the traditional discounted cash flow method but also evaluates economic value added valuation (EVA), accounting impact and additional quantitative investment performance indicators. The logical input flow makes usage straightforward to gain quick results for business strategy decision making. Simple and flexible input with embedded help prompts facilitates application to required valuation dynamic. The financial accounting impact is analyzed including Profit and Loss Statement, Balance Sheet and Cash Flow Statement. An optional tools is included to calculate the weighted average cost of capital under the capital asset pricing model. Economic value added calculation parameters include flexibility for identifying economic costs with allocated amortization periods. The financial calculations accurately account for asset purchases, disposals and depreciation with capital and gearing impacts. Investment and business valuation can be applied to new businesses or changes to existing investments. This functionality also allows the comparison between two alternative strategies, such as lease versus purchase. An alternative finite terminal value calculation can be applied to mimic new economy investment and product life cycles where return cannot be expected to persist indefinitely. The customizable Comparative Investment Score can be set to evaluate and prioritize different investments depending on the prevailing business environment. The Investment and Business Valuation template is compatible with Excel 97-2013 for Windows and Excel 2011 or 2004 for Mac as a cross platform business valuation solution.

Back to Investment and Business Valuation Details page

- Valuation Investment

- Investment Valuation

- Investment Valuation Template

- Business Valuation

- Calculate Business Valuation

- Business Valuation Letter

- Valuation Business Calculator

- Easy Business Valuation

- Business Valuation Freeware

- Business Valuation Template